Jane Fraser plans to make people redundant this year. Her hit list could number as many as 20,000, but that would still leave the Citigroup chief executive with around 200,000 staff. She has made clear that they will only survive if they deliver profits for the bank. “We are not graded on efforts. We are judged on our results,” she wrote in her New Year message, adding that this would be the relentless demand every single quarter.

Citigroup’s mission statement is similar to almost every other large business organisation, emphasising trust, principles and care for the customer. But Fraser, born in St Andrews, has cut through the rhetoric to emphasise what really motivates the financial world. With only the rarest of exceptions, it is the drive to make money, some for investors and lots for the executives.

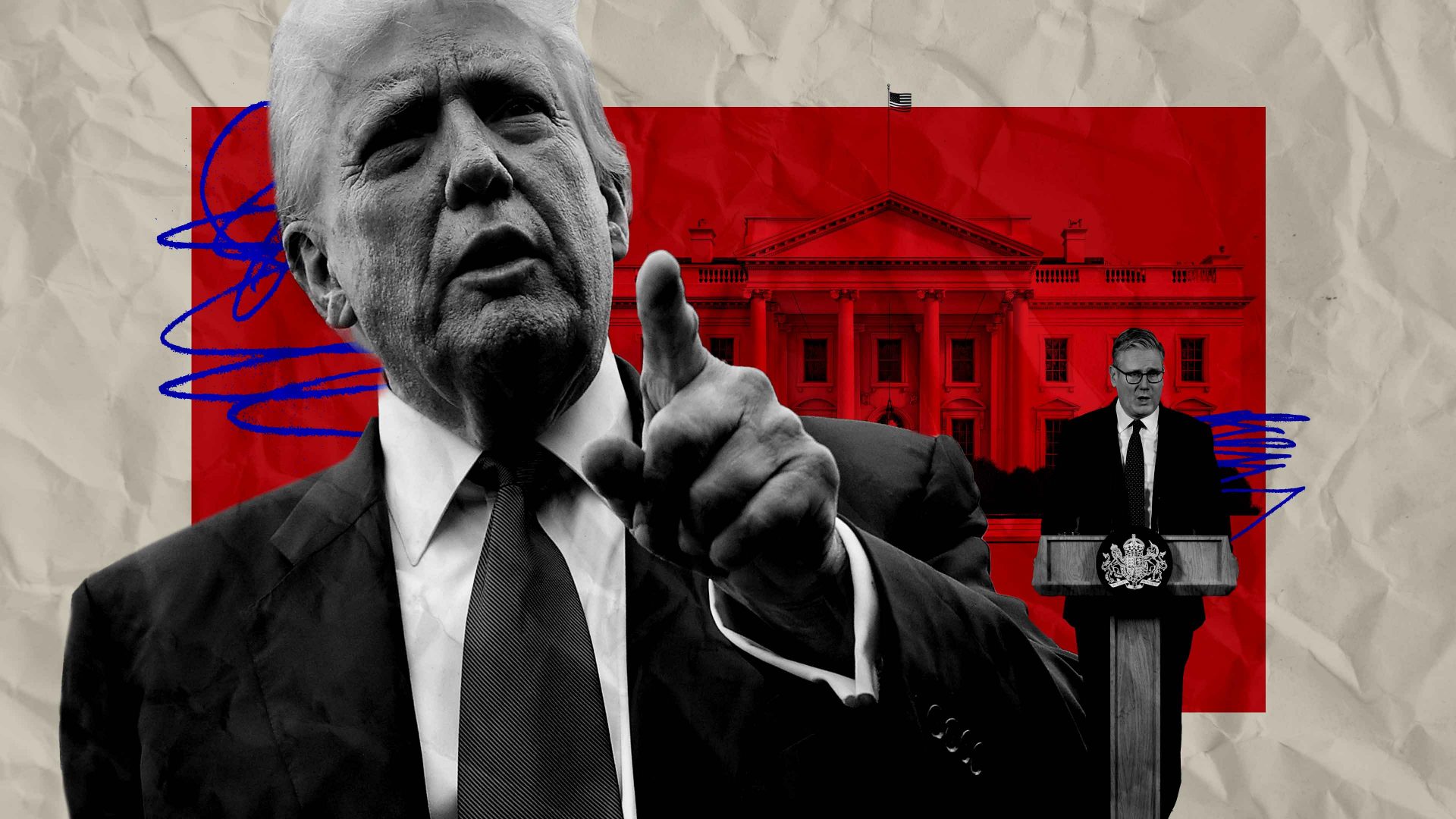

Bankers do not bemoan Brexit. Most of them saw it as an opportunity for gains, some short-term and others more long-lasting. Now that a “reset” of the relationship between the UK and the EU is in the offing, they certainly do not want to see their industry involved in any sort of realignment with the EU. Prime minister Keir Starmer has clearly received that unequivocal message and has now said that banking and the financial services sector will not be included in discussions with the EU.

Why is the sector so vehemently opposed to any alignment? One need look no further than the cap on bankers’ bonuses, a perfectly reasonable measure introduced in the wake of the 2008 financial crisis to curb risky activity. Brexit freed British banks from this limit, and the result has been bumper payouts. The data for 2024 shows that UK bonuses not only left EU bankers far behind, but also outstripped Wall Street.

Many pundits predicted that Brexit could devastate the City of London, but this didn’t happen. Banks adapted their structures; some jobs, and many name-plates, have moved outside the UK, but much of the business has been retained by the organisations that are usually at least as international as their clients.

So, as usual, it is the financiers who are the winners. Most of them kept their views relatively private as the debate raged over whether the UK should remain in the EU, but the staunchest advocate of Brexit came clad in the uniform of the City, topped with the obligatory velvet-collared overcoat.

Nigel Farage, the begetter of Brexit and most recently leader of Reform, was a relatively low-level City trader before he turned to politics. He has certainly profited from his political career. Not only has it provided him with approval ratings that his time as a young, apparently racist, student at Dulwich College most certainly did not, but it has provided him with numerous sources of income. He is a television presenter, a radio talk-show host and will advertise gold bars if the fee comes measured in carats.

Farage found many Brexit allies in the City. These included fund manager Crispin Odey, now notorious for a string of allegations of sexually assaulting women that led to suspension by the Financial Conduct Authority. Odey is also infamous for placing financial bets that benefited from the Brexit he helped to fund. More recently, in 2022, Odey’s funds made massive profits betting against sterling.

Suggested Reading

A new year’s resolution to keep: get rid of Brexit

Odey had been a major Conservative Party donor. He also employed Kwasi Kwarteng before he became a Conservative MP. Kwarteng supported Brexit in the 2016 referendum and eventually, as potential candidates for the position vanished, reached the high office of Chancellor of the Exchequer in that brief period of madness when Liz Truss was prime minister.

Kwarteng decided to stand down as an MP at the following election and is now busy making money again. Most recently, the Eton-educated Brexiteer has joined Gunster Strategies Worldwide, a communications and public affairs firm. “Our mission is clear,” it boasts: “Get used to winning.”

That is a mission the financial world and its players well understand – it is not a mission that has any space in it for closer relations with the EU.