It’s easy to forget, but long before the current AI bubble was ever dreamed of, there was a yearlong period during which NFTs (Non-Fungible Tokens, for those of you who have scrubbed the entire period from your mind) were the hottest thing in the world, attracting billions in investment, dominating the news agenda and were being pushed by celebrity backers from Paris Hilton to Ozzy Osborne to, er, John Terry.

Even then-chancellor Rishi Sunak announced that the Royal Mint was going to create its own NFT for, presumably, the betterment of the nation. Then, of course, it all fell apart, and no one really seems to want to talk about it much anymore. There is now a sense of alarm that the AI bubble is going to pop – but what happened to the last big tech craze that turned into a bust?

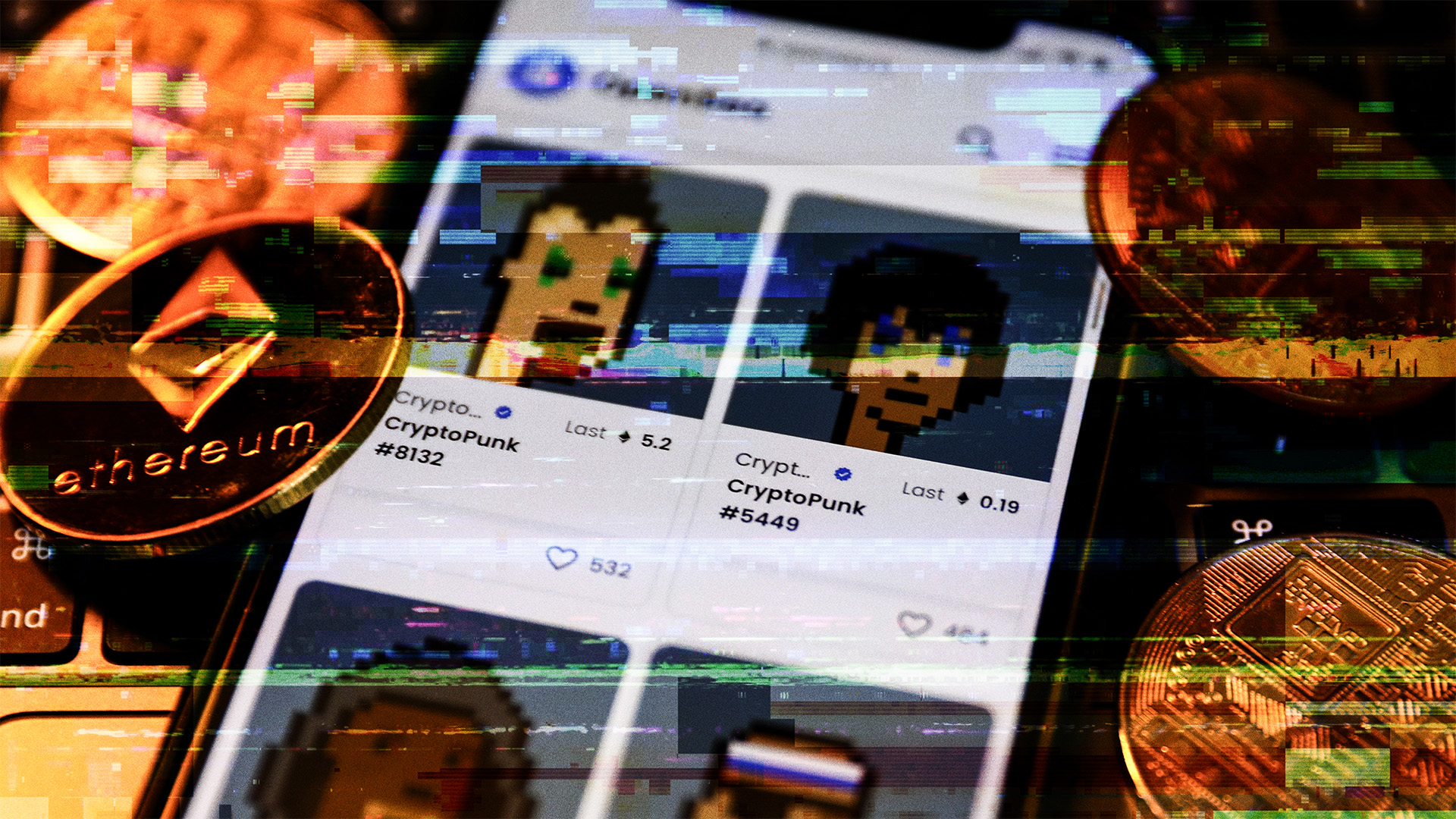

A “Non-Fungible Token” is, basically a verifiable digital ownership certificate for digital or physical objects – owning an NFT means your ownership of a specific digital item is logged on a public ledger, much like owning a collectible with a provable provenance. This public ledger is the blockchain, the same technology underpinning Bitcoin and other cryptocurrencies, but if you want an explanation of that then you can find your own. It’s all hideously complicated (and quite boring), but, basically put, an NFT is a digital footprint that says “this person owns that thing”, and which records all the transactions associated with that thing so as to be able to track its provenance, past ownership and sales record.

NFTs were initially conceived in the mid-2010s, and attracted interest from digital artists who realised that what this technology effectively did was introduce the concept of scarcity to digital goods. While anyone can reproduce a digital image, if there’s a verifiable record pointing at the original image then all of a sudden we can introduce concepts like “buying and selling” and “limited editions” and “one-offs” and “percentage of resale”, which all of a sudden made digital art a potentially-viable way of making money: very much the art world’s raison d’etre.

A few art projects sprang up and gained traction in the late-10s, things like Cryptopunks (pixellated avatars of, er, punks) and Cryptokitties (pixellated avatars of, er, kittens) demonstrated that the basic idea of letting people buy and trade digital objects for real-world money based on the fact that their ownership of those digital objects is recorded forever on an immutable ledger, had legs.

Interest in NFTs as a technology grew steadily and boomed during the early months of the pandemic. Global central banks flooded markets with easy money, driving investors toward riskier assets in search of returns. Cryptocurrencies like Bitcoin and Ethereum soared in value, creating new crypto-rich investors looking for the next big thing. NFTs – combining tech novelty, digital art, and the allure of crypto profits – fit the bill.

Then an auction changed everything. On March 11 2021, Christie’s held its first ever sale of a purely digital artwork. The piece, “Everydays: The First 5000 Days”, was a collage of 5,000 images by a digital artist known as Beeple and sold for $69,346,250, instantly making Beeple the third-most expensive living artist at auction. (Take a moment to Google Beeple’s oeuvre; I will leave it to you to decide the degree to which he merits this accolade).

Perhaps unsurprisingly, things suddenly got a bit silly. Millions of people worldwide suddenly realised that “selling a jpeg” was now a potentially-viable route to millions; millions of others realised that this created new markets, and markets can be exploited.

Everyone got in on the act. Celebrities minted NFTs in their own image. Ozzy Osborne (or the Ozzy Osborne brand) released a limited edition range of images of cartoon bats, each unique and available for purchase. Internet memes were monetised, with an NFT of the original “Doge” meme selling for about $4 million in mid-2021. Auction houses began hosting high-profile NFT sales; a single Cryptopunk sold at Sotheby’s for over $11 million. Paris Hilton shilled Bored Apes (briefly the buzziest of all the NFT collectibles, trading for hundreds of thousands at their peak) on Jimmy Kimmel. Even The Economist auctioned an NFT of one of its covers (titled “Down the Rabbit Hole”) for about $420,000 in October 2021.

Suggested Reading

Return of the glassholes

It wasn’t just “artworks”. The NBA introduced the ability for fans to buy NFTs of videoclips of basketball games, letting superfans “own” a gif of Lebron James dunking on a loop, forever. Luxury brands started selling NFTs as digital “loyalty cards”, granting buyers access to exclusive drops or online experiences.

Digital Real Estate Agents (no, really) sold NFTs of parcels of “digital land” in the metaverse, with platforms such as Decentraland flogging “plots” for hundreds of thousands of pounds despite the fact that nobody wanted or needed “digital land” in 2021-2 (or indeed now). NFTs were going to transform collecting, memberships, property, the world!

There was a brief, hallucinatory period when you could overhear tables of normal-looking people in pubs discussing the pros and cons of “getting an Ape”, and tales abounded of people who got in early making huge gains from “flipping” NFTs. Then, of course, the bottom fell out of the whole thing.

It turned out that the resale value of a jpeg, even if it is the original, was, in many cases, £0. The guy who bought the NFT of Jack Dorsey’s first ever Tweet for $2.9m in 2021 found a year later that the market valued it at circa $280. Celebrity NFT projects turned out to be flops (Ozzy’s bats are now worth roughly £30 now, vs over £3,000 at launch).

Reports spread of scams, hacking incidents, and “rug pulls” where NFT project creators vanished with investors’ money. Combine that with the end of the zero interest rate era, the collapse of crypto in 2022, and growing questions about the energy use and environmental impact of the technology, and confidence in NFTs as an investment vehicle, and with it a lot of people’s investments, crashed. By late-2022, NFTs were a punchline rather than a headline.

A lot of people lost a lot of money; with a few small exceptions, the many millions of NFT collections that were minted during the boom year held no value whatsoever. Research from 2023 showed 95% of NFT collections had effectively become worthless, and that roughly 23 million people held assets essentially worth nothing.

The artists who briefly believed that they had found a way to sell digital copies of their work in the main realised that it’s harder to persuade people to shell out for a digital file than a painting, even if that digital file does come with a certificate of authenticity backed up by some really hard maths.

As to who won? Well, Beeple is now richer than God, and a handful of other artists managed to ride the early wave successfully; the auction houses taking a cut of those early, frothy megasales certainly benefited; a few celebrities managed to sell their branded NFT collections at the height of the bubble. Otherwise, though, the main beneficiaries were the platforms facilitating the trade in NFTs and the scammers who sold people a get-rich-quick asset-flipping narrative and then disappeared with hopefuls’ cash.

Was it all rubbish? A fever dream born of the pandemic-era when we were still addled by lockdown? Not entirely. The fundamental technology underpinning NFTs – that is, an immutable record of a digital asset’s existence, ownership, etc – remains viable. There are corners of the web in which NFTs continue to be traded, albeit at significantly lower volumes and for smaller sums. Game developers continue to explore the concept of NFTs allowing for real-world ownership of exclusive digital assets. There are applications across digital ticketing and even digital identity.

It’s perhaps fairer to see NFTs as an example of a technology that got famous before we had quite worked out what it was for, which became the subject of frenzied, ill-informed speculation by a society obsessed with both novelty and the idea of being able to get very rich very quickly with minimal effort. Once the initial hype dissipated, it left a lot of people looking and feeling very stupid, and very poor. The question now is whether we are heading for a re-run.