The huge damage caused by the spike in energy prices following Russia’s invasion of Ukraine is still fresh in our minds, so it is hardly surprising that the markets are nervous about the conflict between Israel and Iran causing significant economic damage.

Iran is not just a massive producer of oil and gas. A lot more oil from the other Gulf states passes through the Straits of Hormuz and Iran has “history” when it comes to trying to close those straits at times of conflict and tension.

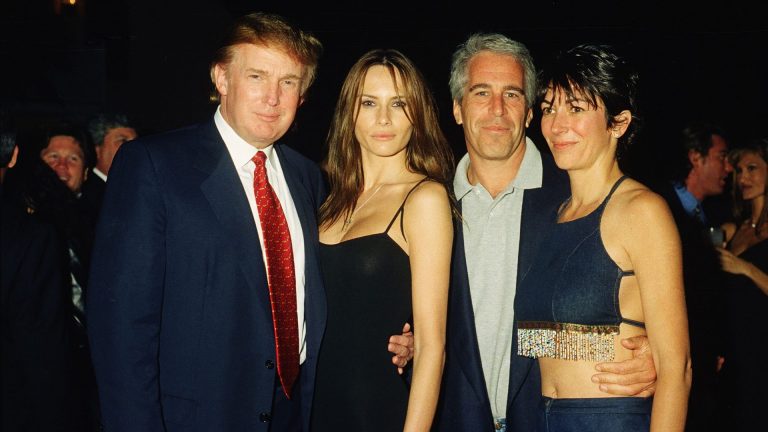

And then there is the very real risk that the bumbling blowhard in the Oval Office will come in on the Israeli side and start a much wider conflict – his “maybe I will, maybe I won’t” ramblings and his calls for Iran’s “unconditional surrender” are worrying the markets.

But in these tense times, there is some positive news for the rest of us. While shipping insurance rates are soaring, which is to be expected in these cirumstances, the price of oil – which impacts the world’s fuel bills – is not.

The latest report from the International Energy Authority found that with lower Chinese and American demand and with oil-producing countries increasing their output, there is currently no world shortage of fuel. Iran is deeply unpopular with many Gulf states, who see it as a huge threat to their own security, and they therefore have a direct interest in opening the pumps to thwart any attempts Tehran might make to “punish” the West with higher oil and gas prices.

Suggested Reading

Trump and Netanyahu – two authoritarians in search of a legacy

So, while oil prices are rising, this is nothing like the last energy shock. The benchmark for oil pricing, Brent crude, has risen from $68 a barrel to around $76. It’s a significant but not game-changing increase.

Contrast that with 2022, During the height of the Ukraine/Russia energy crisis, Brent crude reached almost $140, petrol prices in the UK reached a record £1.55 a litre and inflation generally took off. Governments in many countries had to intervene to subsidise energy use for fear of real suffering and economic damage.

That does not mean that things could not get worse very quickly. Israel could try to destroy Iran’s oil and gas industry, its ability to pump, refine and export energy. America entering the conflict could easily make things far worse.Iran could lash out. Yet so far at least this has not been a huge shock to the world’s economy.

This is all welcome news to many countries including the UK – an energy shock is the last thing we need. Inflation is still over 3%, growth is weak and erratic, finances are stretched, room for manoeuvre is limited, and Trump’s insane tariffs are already doing damage.

Suggested Reading

The father of Iran’s nuclear programme

Having to find to the money to bail out the economy for the third time in five years after Covid and the Ukrainian energy shock, would be a big ask, we nor anyone else can afford to keep supporting the whole economy time after time.

But so far, the tragedy in the Middle East is a military and humanitarian one, not an economic one.

If Trump cares about anything (and that is a big if), it is keeping the price of energy in the US down. We have to hope that overriding obsession will keep this conflict from causing lasting economic damage.

Iran spike global fuel costs?