I do not normally have much time for MPs like Nadia Whittome. She is one of the left-wing members of the Labour party who, I think, are the mirror images of their Tory opponents, the ones who think being just a little nastier and filling in the Channel Tunnel will solve all of the nation’s problems.

In the Left’s view the normal solution to any and all problems is to just tax the rich “until the pips squeak” – and now Ms Whittome has come up with ten suggested policies, which she has revealed on social media and which are not all bad. They are as follows:

- Equalising capital gains tax with income tax rates (will raise £12bn)

- Ending “stealth subsidies for banks” (£50bn)

- Taxing gambling (£3.4bn)

- Forcing corporations to declare profits in the country in which they operate (£15bn)

- Applying National Insurance on investment income (£10.2bn)

- Ending fossil fuel subsidies (£2.2bn)

- Taxing private jets (£1.2bn)

- Close the carried interest loophole for private equity (£0.5bn)

- Four percent tax on share buybacks (£2bn)

- Two percent tax on assets worth more than £10m (£24bn)

I for one would love to tax gambling and private jets a lot more – they are both pernicious and damaging. The carried interest loophole for private equity she mentions is not just stupid but distorts the economy by giving asset strippers a huge advantage over steady, reliable companies. But it would be very complicated to do.

Rather than taxing share buy-backs, I would rather end them. They only push up share prices and bonuses for the bosses. The money should instead be invested or paid out in dividends, which are already taxed.

But that is four out of the 10 new proposals; the other six are, however, nowhere near as sensible.

Ending “fossil fuel subsidies” ignores the fact we still need fossil fuels. Taxing their use would make much more sense. The problem, however is that such taxes are desperately unpopular with drivers, especially poorer drivers, and no one has been willing to do it since the transport protests of 2000.

Suggested Reading

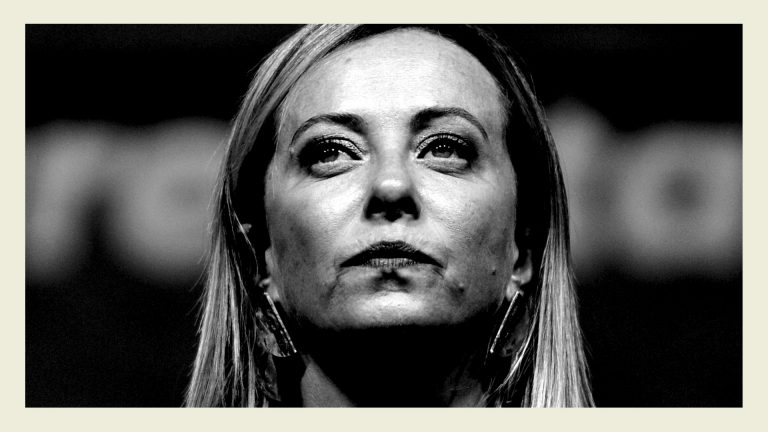

Is Meloni now leaning to the left?

While capital gains have a lower tax rate than income tax, equalising the rates goes too far and would hit investment, which we are supposed to be encouraging.

Ending “stealth” subsidies to banks would apparently raise £50bn. This is based on the idea of not paying commercial banks interest on reserves they have to deposit with the Bank of England. But the £50bn figure implies that no interest would be paid at all, which I don’t think any other central bank has tried; it is more likely the Bank of England could save £5-8bn this way.

You can try to tax international companies like Amazon in the place where they do business, and the current system is distorting the economy to their benefit to a maddening degree. The problem is that numerous countries have tried and failed to do this and anyway president Trump has their back.

Applying National Insurance to investment income is another tax on investment, which does need to rise. Instead, you could just increase capital gains tax. Why bother with a completely new and doubtless complicated tax system for investment?

Finally, Labour’s left wants a 2% tax on assets worth more than £10m which, it claims, would raise £24bn. All I can do here is to quote the IFS: “No country has successfully introduced a wealth tax”.

So, none of the taxes she proposes which I think will work will raise very much, some are socially desirable in their own right but are not real revenue raisers and many of the others would just cause the rich to hide their money even better, while damaging investment and growth.

I am afraid that raising huge amounts by taxing the rich sounds easy but it is not. The big revenue comes from VAT, income tax, and NI. Fuel duty increases would raise a lot, and help the environment, but all politicians are cowards on that one, including, it seems, Ms Whittome.

We do need to tax capital more, but the obvious change which does raise a lot of revenue is to freeze income tax bands yet again and pray for higher growth. But that’s not something the left will want to hear.