If you thought Liz Truss was an economically illiterate moron who almost crashed the economy with mad tax cuts and giveaways, based on the harebrained idea that trickle down economics would pay for itself, then I should warn you – you ain’t seen nothing yet.

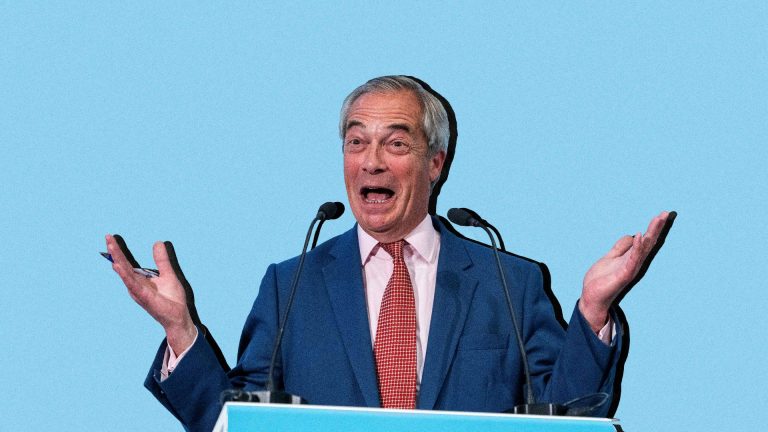

Reform and its leader Nigel Farage are finally having to actually announce some policies, now that they are ahead in the national polls, and in control of various councils across the country. They make Liz Truss look like John Maynard Keynes.

Reform is planning a series of colossal giveaways. These are “financed” – if that is the right word – by a series of cuts to public spending. Their menu of economic policies includes: increasing the personal tax allowance from £12,570 to £20,000; the abolition of inheritance tax; raising the VAT limit for small businesses from £90,000 to £150,000 and slashing corporation tax.

Reform plans to sell a “Gold Britannia card” to foreign nationals. They will pay a one-off fee and after that they will not have to pay any tax on their foreign wealth, or any inheritance tax.

All of this would be paid for with a Trump-inspired purge of public spending, which is completely fanciful. Scrapping net zero would save £40bn, claims Reform, even though it costs nothing like that much – most of the money spent is not the government’s and the green technology we are developing will make a net profit by 2050. Reform even suggests that ending diversity policies will save £7bn – and so, delusionally, on. The figures are ridiculous, obviously invented and bear no relation to reality. Which means the enormous tax giveaways aren’t backed by any corresponding savings – and they are truly staggering in scale.

Raising the income tax threshold to £20,000 a year is the most expensive by far. This would lift millions of people out of paying any tax, but it is also a huge tax cut for the wealthiest in society who are the biggest winners by far. The details are vague but the plan also includes a tax cut for married couples, with one partner getting a tax-free allowance of £25,000 a year. Helen Miller, deputy director of the Institute for Fiscal Studies, says: “It’s not possible to put a precise number on the cost of this promise, but it could easily be in the range of £50bn to £80bn a year.”

Suggested Reading

Will Farage be prime minister? Really?

The biggest gainers from this would be the highest earners. The low paid would make around £600 a year from the increase in thresholds, but the wealthiest 10% of the population would make £6,000 a year. Nigel, the friend of the poor, put-upon, hard-working, low-paid, left-behinds, is in fact proposing huge tax cuts for the wealthiest, paid for by huge cuts to the services that the poor use most.

Poor people and even reasonably wealthy people don’t pay inheritance tax either. You have to die with assets of more than £325,000 if you are single, £650,000 for couples plus a housing allowance of £175,000 – so that’s £825,000 in total. Which means that 94% of all Brits are too poor to pay this tax, which brings in around £9bn a year. So if Nigel is planning to abolish inheritance tax, it’s just another massive handout to his wealthy backers.

Raising the VAT limit for small firms will please many people who have their own companies, but Reform is also promising to lower corporation tax to 15%. The cost of that cut alone would be well over £30bn, and the largest companies would benefit the most. Just last week we learned that HMRC is already failing to collect 40% of corporation tax due from small businesses. There seems little point in massive unfunded tax cuts for a sector that is not paying its fair share anyway.

Farage also wants to reinstate the winter fuel allowance, including for wealthy pensioners, and end the two-child benefits limit. Both will almost certainly be done by Labour anyway, but Nige will doubtless try to claim the credit; cost £5.4bn.

All in all, Nigel Farage is planning cuts for British taxpayers worth more than £124.4bn a year, with no idea of how to pay for it. But that is before we get to the jewel in the crown: a massive tax cut for foreigners.

The so-called “Gold Britannia card” will be sold to foreign nationals for £250,000. Reform seems to think this will bring in up to £2.5bn each year, but overlooks the fact that it is a straightforward exercise on tax dodging. It will therefore cost billions more than it raises and will be a massive tax cut for some of the richest people in the world. Farage claims he will “distribute” the £2.5bn raised to the “lowest paid 10% of full-time workers”. But the poorest paid workers don’t work full-time – and there won’t be any money to give them.

In fact, this policy is so expensive it would collapse under its own weight. It would offer £30bn plus of tax giveaways to the richest tax dodgers in the world over five years, or £6bn a year. Many of the winners from this scheme already live here and will get enormous tax cuts. Many more tax dodgers will come here to milk the system – the inheritance exemption alone is worth much, much more than £250,000 to anyone with a few million in the bank.

In all, Farage wants to give away around £130bn a year. To put that in context, that is more than double the defence budget, more than the whole education budget or almost every single OAP’s state pension, gone for ever.

Or think of it this way: Mad Liz Truss crashed the markets with an unfunded giveaway of £160bn spread across five years. Farage’s giveaway will be £130bn a year, every year, for ever. I wonder what could possibly go wrong?